Currencies Outlook – US dollar high(er) for longer

- 30 November 2023 (5 min read)

Key points

- The US dollar looks set to remain supported by high US yields and a continuation of US’s macro resilience

- Both the euro and sterling are not cheap, with weaker fundamentals and are likely to depreciate

- In a US soft landing scenario, high betas might get a chance to finally shine. The Norwegian krone is particularly cheap

- Japan’s yen might breathe again if rates stop rising, but don’t expect it to steal the show

Fed, not US dollar, peak

After markets’ multiple attempts to call the Federal Reserve's (Fed) last hike in this policy cycle, it seems we have finally reached it. At its last meeting it left policy unchanged at 5.25%-5.50% and while the Fed is reluctant to say it has peaked, we believe it has. Rising US rates have been a key factor behind the US dollar’s (USD) strength in 2023 but it doesn’t mean it is doomed to fall if rates stop rising. Looking at previous cycles (Exhibit 1), there is no clear evidence to suggest this, particularly looking at the 1970s and early 1980s high inflation periods.

Exhibit 1: Fed peak not necessarily leading to USD weakness

US inflation is softening but not yet back to target, and neither the economy nor labour market have materially decelerated. The transmission of tighter policy seems particularly slow and as long as the market keeps pushing back the perspective of rate cuts, the USD will remain supported.

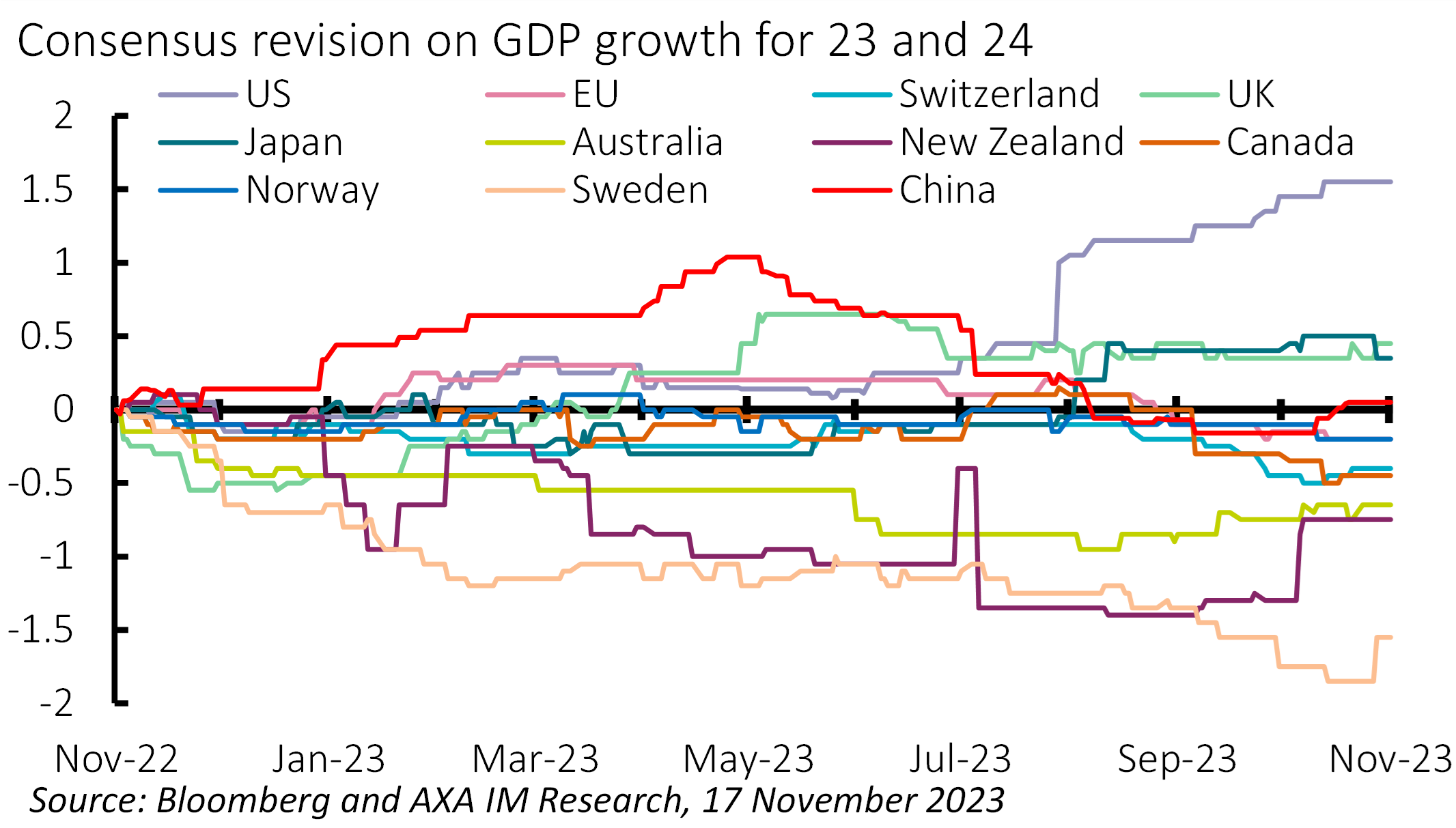

The greenback is undoubtedly not cheap but for good reasons. It has now become the undisputed high yielder within the G10 – even against the renminbi (RMB). Additionally, as mentioned, the US is showing much greater resilience against global monetary policy tightening (Exhibit 2), which supresses the point in the horizon where it might be ousted by foreign yields. Stability in yield differentials might only mean USD stability, not strength. But the market is so far only expecting other central banks to mostly match the Fed’s cut pace, not exceed it.

Exhibit 2: Unrivalled US exceptionalism

Reality check for euro and sterling

The euro (EUR) is firmly in the expensive camp too. When looking at the real effective exchange rate, it has actually appreciated the most amongst the G10 (Exhibit 3). Not only did it depreciate by less than most against the USD but it also endured a much higher PPI-based inflation trend, looking at a seven-year time horizon (both criteria found as the most statistically relevant, focusing on more tradable items).

There are fewer reasons to support such a valuation. The Eurozone economy has slowed more than the US, inflation is falling faster, and European Central Bank (ECB) policy appears more fragile than current Fed pricing, while higher EUR rates would raise further concerns about Italian sovereign debt. Unlike in November 2022, when the prospect of China reopening was boosting global growth forecasts, the potential rebound on this front looks much slower. Indeed, we expect an upcoming growth differential with the US and a renewed focus on ECB balance sheet policy to lead the EUR/USD back towards parity in 2024.

In the post-Brexit world, sterling (GBP) also does not appear to be particularly cheap, although less expensive than EUR. The UK economy has also broadly stagnated over the past 18 months, with the prospect of further weakness ahead. Transmission of Bank of England (BoE) policy tightening is typically faster – the labour market appears to have turned and potential interest rate cuts seem underestimated, relative to other central banks. GBP/USD should also adjust lower.

NOK’ed out but getting up off the canvas

High beta currencies failed to strengthen materially in this cycle and appear – on average – rather cheap. This might in part be explained by their incapacity this time to deliver a higher yield than the dollar. This also might in turn reduce the potential drawdown under risk, from a move towards lower yields.

USD rates have been a dominant driver in 2023 and left little room for high beta currencies with unexceptional yield momentum. Risk sentiment needs to take the driving seat again for those to rise. This might be the turn the USD has recently taken with rising confidence in a soft landing (Exhibit 4).

Australia, New Zealand, Sweden and Norway all have highly indebted households with short-maturity mortgage resets which could lead their economies to decelerate faster. But if a global soft landing emerges Norway’s krone (NOK) has more potential for a comeback from a currently very cheap valuation. Domestic growth looks more resilient than in Sweden. Both the Australian dollar (AUD) and New Zealand dollar (NZD) are also currently impacted by their ties to Chinese growth, although the domestic housing markets appear in better shape.

Exhibit 3: EUR not cheap, but NOK and JPY are

Japan’s yen: Rate differential is yesterday’s enemy

The yen’s (JPY) sharp undervaluation is fully explained by the divergence between Fed and Bank of Japan (BoJ) policy. The USD/JPY has been faithfully tracking the US-Japan 10-year rate differential over the last two years, while the BoJ maintained its yield curve control (and negative rates as the Fed hiked by 525bps, with echoes from other central banks impacting all JPY crosses.

Now the Fed has probably peaked, the next move is for (eventually) lower rates, which should take pressure off the yen and allow some rebound. But as discussed, US rates may remain high for longer – any bounce might be slow and limited, in particular against the USD. And with a 6% adverse carry, there is no incentive to position too early. We do expect the BoJ to shift away from accommodative policies, albeit cautiously, waiting for confirmation on wage growth, while inflation is decelerating globally and not rising locally.

Exhibit 4: USD torn between Rates and Risk drivers

Renminbi’s golden parachute

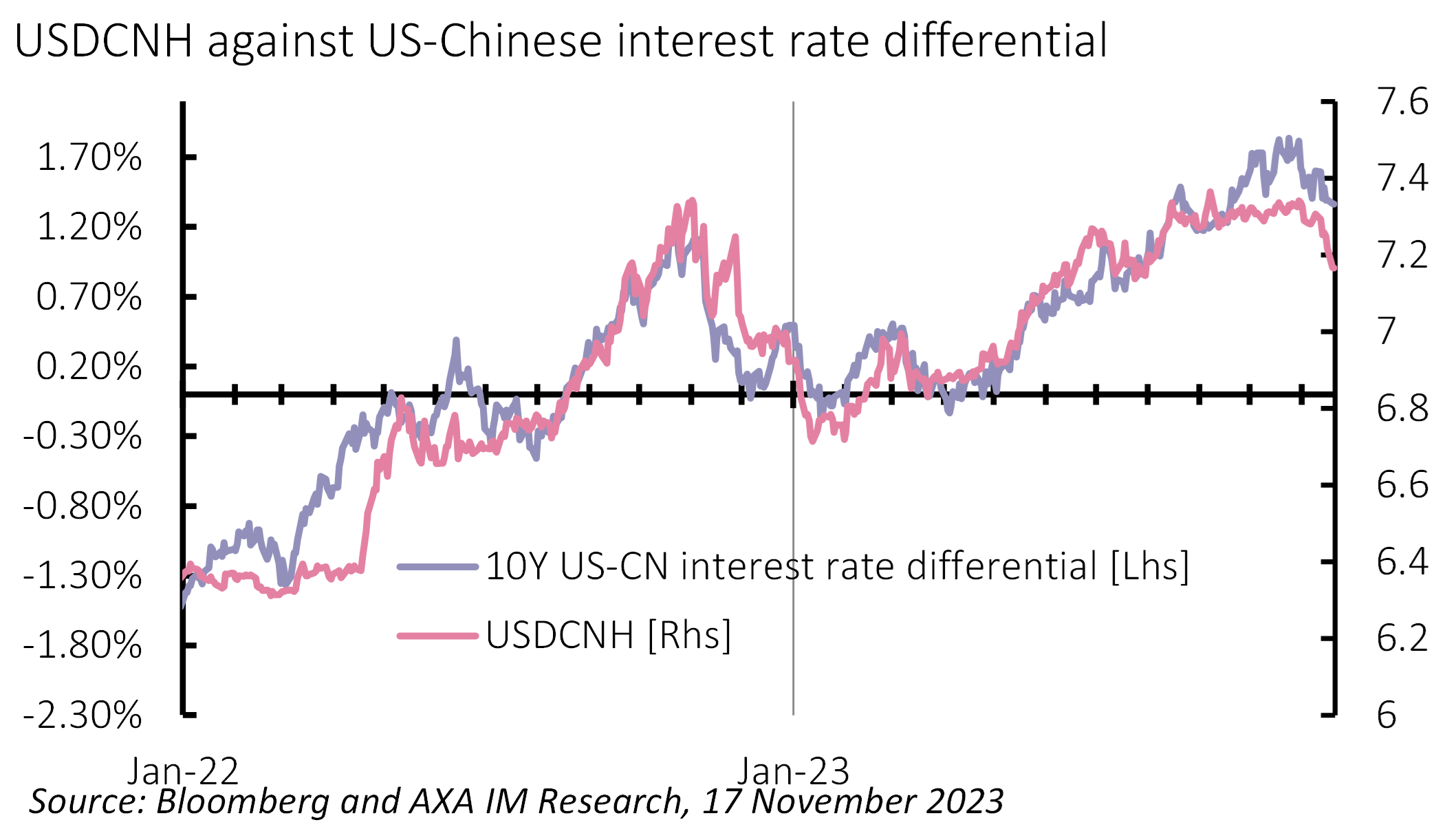

As with the JPY, policy divergence is the main reason for RMB weakness over the past two years - and there is also a very close link between the 10-year rate differentials and USD/CNH – offshore renminbi (Exhibit 5). The People’s Bank of China (PBoC) is maintaining lower domestic rates to manage the transition and revive its economy. China’s growth failed to rebound as quickly as expected in 2023 after reopening and fiscal support remained limited to avoid reigniting excess leverage until the second half of 2023. Investment flows should remain muted with such low rates and higher geopolitical tensions. The trade balance has also yet to deflate from pandemic-era levels, as global demand decelerates, and China imports rise again.

The PBoC is trying to resist those weakening pressures on RMB by maintaining lower USD/CNY fixing and withdrawing liquidity. This policy might take a heavy toll on foreign exchange reserves if USD rates remain high for longer.

Exhibit 5: PBoC action causing USD/CNH to diverge from rates

Outlook 2024: Mid-cycle adjustment, not end-cycle crash

Read our views for 2024Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.