2022 emerging market elections: The who’s who and the so what…

- 19 January 2022 (10 min read)

As democratic systems have been put in place across developing countries, investors have had to become increasingly vigilant around political events – especially elections and referendums. In many emerging markets, election years have coincided with a boost in fiscal spending, which has often led to a significant deterioration of already fragile fiscal positions. This in turn has increased dependency on foreign financing which, exacerbated by an acceleration of foreign capital outflows, can put further pressure on currencies and bond yields. Inevitably, a lot of developing country crises have occurred in sync with political cycles. However, as emerging markets see democratic traditions mature, financial and political cycles have decoupled somewhat, thanks to the improved quality of the fiscal and monetary framework.

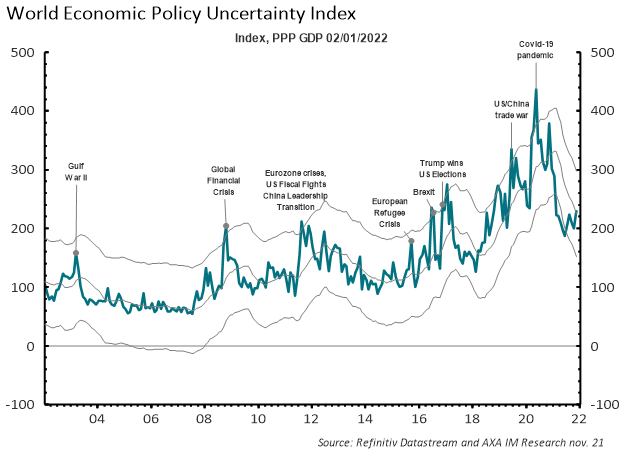

Exhibit 1: Politics and policies in focus

Since 2008, market sensitivity to politics has nevertheless increased, particularly in advanced economies, as highlighted by events such as the European sovereign debt crisis, the Brexit referendum and trade wars. Moreover, the ongoing COVID-19 pandemic has caused significant policy uncertainty across the globe. It has also likely exacerbated inequality and poverty, with lower-skilled workers most affected and poverty increased substantially in low-income countries with weak social safety nets. Poverty, income inequality and demographics make poll outcomes more difficult to predict and give populist candidates a stronger hand. Political volatility is thus again increasingly evident in emerging markets where voters can move decisively away from political incumbents. Such a reversal occurred unexpectedly in Zambia last year when opposition party leader Hakainde Hichilema scored a landslide victory over President Edgar Lungu with an unprecedented voter turnout.

This year several African countries, including Angola and Kenya, will go to the polls and the results could alter political and policy trajectories. Potentially controversial elections also loom in Latin America, with Brazil, Colombia and Costa Rica all going to the polls while Chile will hold a plebiscite on a new Constitution. In Asia, elections in the Philippines need to be monitored for shifting policy direction. In Europe, Serbia has an important electoral year, while populist Hungarian President Viktor Orbán may face defeat after 12 years in power. Given the current backdrop, one thing is certain – no matter who takes office, the economic, social and political challenges have increased in the post-pandemic world.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.