EM Latin America reaction: Growth losing steam

- 19 March 2024 (7 min read)

Weak growth in Q4 across LatAm

Data published in the last weeks show that by the end of 2023 economic activity for Latin America was subdued, as Brazil, Colombia, and Mexico all reported modest growth in the fourth quarter that fell short of market expectations. This broad deceleration can be attributed to several factors, including a natural tapering after the strong post-Covid rebound. Additionally, less supportive external conditions, such as slower growth in trading partners, tight global financing conditions, and declining commodity prices, along with the delayed effects of earlier domestic monetary tightening, have all contributed to this subdued performance across the region.

As we move through 2024, a dual narrative should emerge. Brazil and Mexico are expected to experience a leveling off in growth after surpassing expectations last year. Meanwhile, the economies of Chile and Colombia should gain momentum after a dismal performance in 2023. Despite these differing trajectories, what remains consistent is the convergence of these countries towards their respective low potential growth rates. This convergence raises the question of whether these potential growth rates have changed. Evidence of nearshoring initiatives in Mexico and a continual increase in oil production in Brazil, facilitated by liberalization measures in the sector, suggest that the remarkable growth seen last year in these two countries may signify deeper structural shifts rather than merely cyclical fluctuations. Similarly, several large mining projects are set to begin operations this year in Chile, which could boost its growth prospects in the short term.

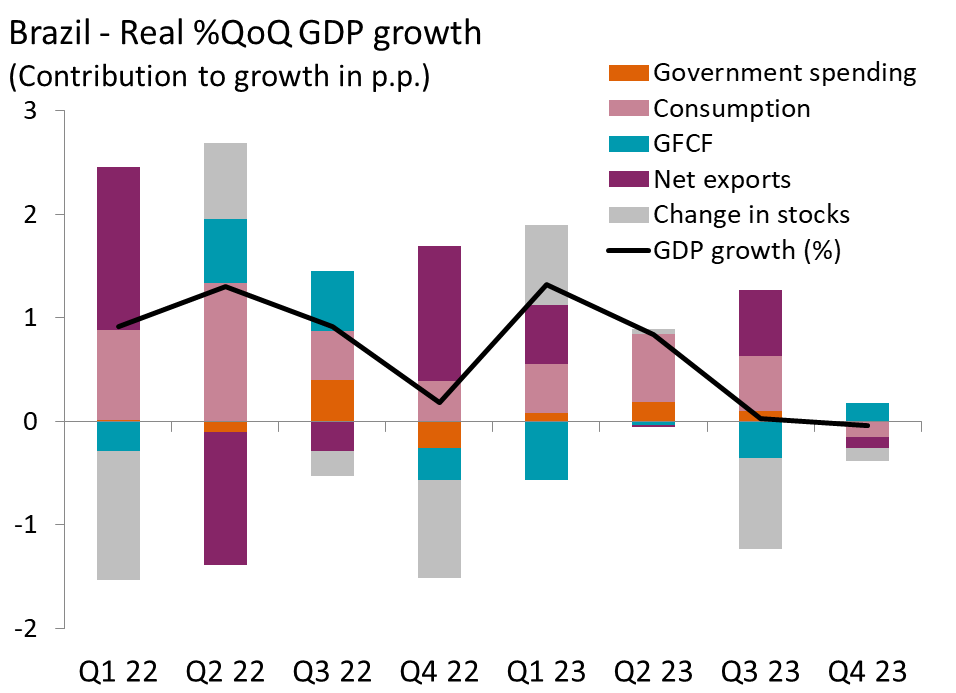

Brazil : Growth stagnant at end-2023

Real GDP growth came in flat (0.0% q/q sa) in the fourth quarter, down from 0.1% in Q3. Q4’s figure fell slightly below consensus expectations of 0.1% growth, marking the weakest performance since Q2 2021. On an annual basis, growth accelerated to 2.1% in Q4 (Q3:2.0%). With this result, Brazil recorded a 2.9% expansion for the full year of 2023, a better-than expected outturn compared to expectations at the beginning of last year thanks to an agricultural boom in Q1, higher government spending and a resilient job market.

The Q4 slowdown and contraction in private consumption confirmed a sharp loss of momentum. The contraction in consumption, the first since Q2 2021, was the main drag on growth, with net exports also detracting from overall performance. Yet, higher government spending and a recovery in gross fixed capital formation (GFCF), the first growth since Q3 2022, helped partially offset these headwinds. In terms of output, the agriculture and livestock sector contracted for the third consecutive quarter in Q4, with services and industry showing growth, albeit at modest rates.

Looking ahead, we expect GDP growth to decelerate to 1.6% in 2024 as the effects of last year’s agricultural boom fades. Private consumption looks set to be the primary driver of growth this year, supported by a strong job market and more accommodative monetary policy, which should also help boost investment. However, the robust export growth seen in 2023 will likely ease this year due to weakening global demand for commodities, dampening overall growth. On a more positive note, there should be an important sequential reacceleration in the first half of the year as falling interest rates reignite growth in cyclical sectors like manufacturing, construction, and retail sales. For 2025, we foresee growth reaching 2.0%, in line with Brazil’s potential growth rate.

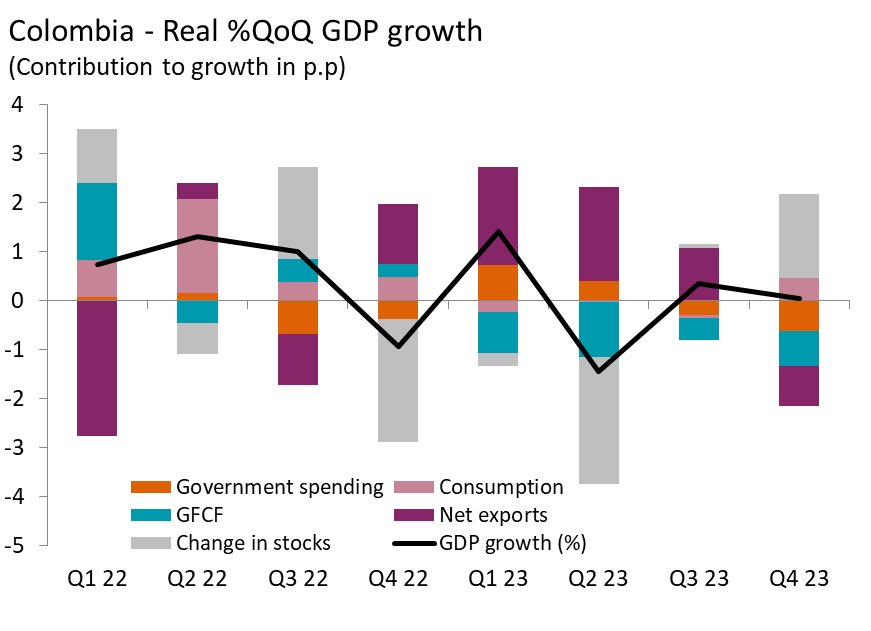

Colombia: Disappointing growth in Q4

Colombia's economy also fell short of expectations, registering a significant slowdown to 0.0% quarter-on-quarter seasonally adjusted in Q4 from Q3's 0.3% figure. Year-on-year growth picked up to 0.3%, up from Q3's -0.6%. The overall picture for 2023 was dismal, with growth a mere 0.6% for the full year, in stark contrast to the robust 7.3% expansion seen in 2022. This weak performance, the worst since 1999 (barring 2020), is largely the result of a tight policy mix aimed at correcting Colombia's macroeconomic imbalances that had accumulated during the post-Covid rebound.

Positive contributions to growth came from changes in inventories and a resurgence in private consumption, which rebounded after three consecutive quarters of contraction. However, GFCF remained a significant drag on growth, struggling in a high-interest environment. Government spending and net exports also weighed on growth in Q4. From an output perspective, agriculture and public services drove economic activity, while manufacturing lagged behind as the primary drag.

Colombia’s sluggish momentum is set to persist well into 2024 as the economy continues to grapple with contractionary monetary policy and low consumer confidence. We expect the economy to gain steam towards the second half of the year as macroeconomic policies gradually normalize, pushing growth to 1.5% for the year. Private consumption will benefit from falling inflation and lower interest rates. Likewise, a looser monetary stance should allow investment to recover after contracting all throughout 2023. However, the external sector will remain subdued by weaker global demand and stagnant oil production. For 2025, we see the economy continuing to recover and grow 2.5%.

Mexico: Economy decelerates in Q4

The Mexican economy decelerated to 0.1% in Q4 from 1.1% in Q3. The figure surprised to the downside and marked the weakest increase since Q3 2021. On an annual basis, economic activity slowed to 2.4%, below Q3’s 3.3% growth. Despite the disappointing Q4 data, the economy expanded by an annual 3.2% over 2023, the best performance among major countries in the region. This resilience reflected a strong labor market (unemployment is hovering around record-low rates) and higher-than-expected growth of the US economy.

The deceleration in Q4 was broad-based, with all GDP components slowing on a quarter-on-quarter basis except for net exports, which rebounded after contracting in Q3. Nonetheless, private consumption remained the main growth pillar, contributing almost 80% to the overall Q4 GDP reading. From a supply-side perspective, economic activity was mainly driven by the secondary sector (including mining, construction, and utilities), followed by the tertiary sector (retail and services). Meanwhile, the primary sector (agriculture, animal husbandry, fishing, etc.) remained stable in Q4.

In 2024, we expect the economy will continue to grow slightly above potential, cooling to 2.2% despite a significant increase in government spending ahead of June’s presidential elections. With more money injected into social programs and public infrastructure, the economy should maintain its positive momentum in the first half of the year. However, growth should start to falter in the second half as tight monetary policy persists and growth in the US, Mexico’s main trading partner, begins to slow. Nevertheless, there's potential for a boost in economic activity in Mexico through ongoing nearshoring efforts. For 2025, we expect growth to reach 2.1% although developments in US Presidential Elections will need to be followed closely.

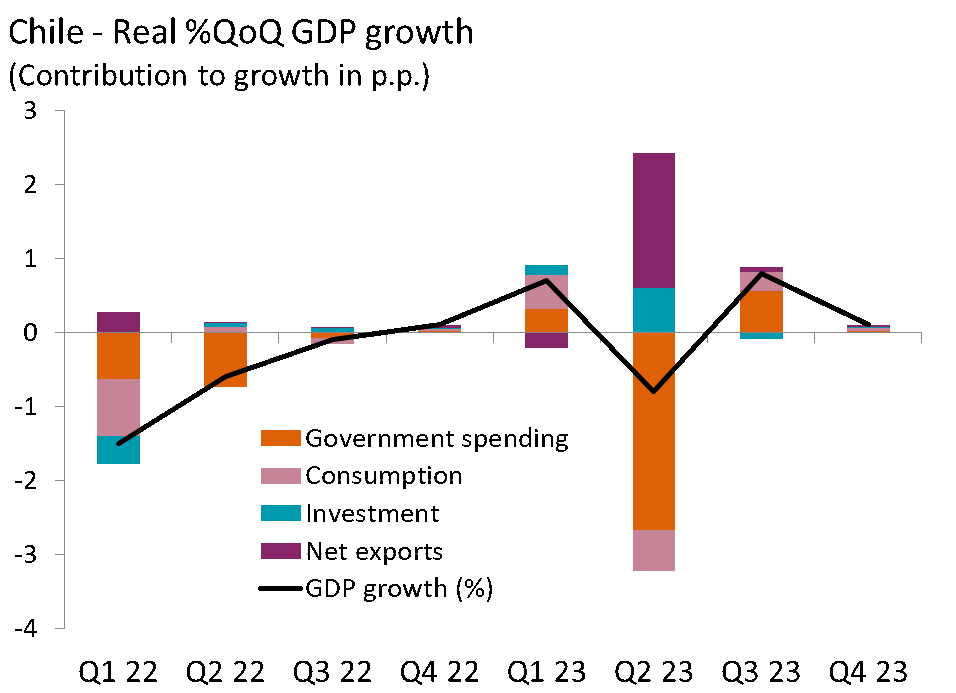

Chile: Contraction narrowly avoided in 2023

Chile's Q4’ performance surprised to the downside with GDP growth decelerating to 0.1% quarter-on-quarter seasonally adjusted, down from Q3's 0.3%.Year-on-year growth also slowed to 0.4% compared to Q3’s 0.6%. Despite these challenges, Chile managed to surpass expectations for the full-year 2023, recording a modest growth of 0.2%. This outcome was partly attributed to upward revisions in GDP readings for the first and second quarters. Nevertheless, Chile still lagged behind other major Latin American economies in 2023 due to a series of challenges such as high interest rates, mining production issues, and low business confidence.

In Q4, growth was mainly driven by private consumption and government spending, which reversed their contractions from Q3. However, investment and net exports remained largely subdued. On the supply side, personal services and transport categories made the most significant contributions to Q4 growth, while the mining sector, vital for Chile's economy, contracted at the end of the year.

Chile’s economy is approaching the end of its adjustment cycle and should start converging towards trend growth, with projected growth rates of 1.5% in 2024 and 2% in 2025. Private consumption should drive growth this year supported by lower inflation, looser monetary policy and increased political stability after years of turmoil, which should also benefit investment. Likewise, the economy is set to receive a boost from mining exports, as large mining projects are slated to start operating this year. However, Chile's economic outlook faces a significant risk from a potential slowdown in China, given its role as Chile's main trading partner.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.