US reaction: Growth slows further, but inflation sting in the tail

- 25 April 2024 (3 min read)

The first estimate of Q1 GDP growth recorded 1.6% (saar), its slowest pace of growth since the economy contracted in H1 2022 (Exhibit 1). This was below both ours and market expectations of an annualized 2.5%. It is also below the pace that we would consider non-inflationary (the potential growth rate) over the medium term, and certainly lower given expected elevated labour supply gains associated with ongoing inward migration.

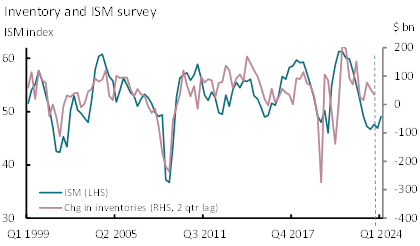

While three months ago, after the release of Q4 GDP we had envisaged Q1 GDP growth of 1.2% (saar), the steady stream of upside surprises in consumer spending (February) and retail sales (March) had led us to revise higher our initial estimates. Indeed, our outlook for consumer spending of 2.5% was on track (softer than the consensus 3.0%). However, other areas of GDP were softer. The main culprit was government spending, which slowed to 1.2% from 4.6% in Q4. Net trade was also weaker than expected, admittedly exports edged ahead again, posting a 0.9% gain against our expectations for a mild retracement from Q4’s strong 5.0% gain, but imports surged up 7.2% this quarter from 2.2% last and faster than we anticipated. Against that investment posted a stronger gain than expected, rising by 5.3% compared with 3.5% in Q4 and driven by a 14% surge in residential investment, while business investment rose by 2.9%, in line with our expectation. inventory held in better than we had anticipated and continues to defy historically reliable indicators (Exhibit 2).

The sting in the tail came from the associated estimates of the consumer price deflator – the Fed’s targeted measure of inflation. On a quarterly annualized basis the headline rose to 3.1% from 1.6% last time around, modestly ahead of the 3.0% consensus outlook, but the core measure jumped to 3.7% from 2.0%, above estimates for 3.4%. These quarterly estimates are consistent with a monthly rise in March’s headline of 0.3%, but suggest a firmer than expected 0.4% for core (or revision to previous monthly estimates). Either way these figures add to the worsening inflation outlook which has contributed to a repricing of the rate outlook in recent months.

This provides a mixed bag for the Federal Reserve. The deceleration in GDP, domestic demand and final sales growth, driven by slower consumer, government and business investment spending all suggest some softening from an economy that had expanded surprisingly strongly over H2 2023. Insofar as we still expect accelerated labour supply to have lifted potential growth in the economy and expect a continued softer backdrop for consumer spending, today’s figures should provide greater confidence for further disinflationary pressures ahead as slack begins to emerge in the economy. However, the short-term developments in inflation suggest less progress than expected and underline our expectation for a delayed easing in the Fed Funds Rate until September this year. But the outlook for growth will continue to be important. For now we expect GDP to continue around this current sub-trend pace over the coming quarters, delivering growth of around 2.4% for the year as a whole, but will review our forecasts after the full breakdown of consumer figures tomorrow.

Market reaction focused on the short-term inflation dynamic. The perceived chances of a September cut fell to 75% from being nearly fully priced and the chance of two cuts this years dropped back to 38% from 70%. Term rates followed the same path, 2-year UST yields rising 8bps to 5.01% and 10-year yields rising 7bps to 4.73%. The dollar also gained by 0.25%.

Exhibit 1: Headline growth rate drops to near 2-year low

Source: BEA, April 2024

Exhibit 2: Inventory rates still seem anomalous

Source: BEA, ISM, April 2024

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.