EM Latin America reaction: Mexico keeps policy rate on hold at 11%

- 09 May 2024 (3 min read)

First pause in the easing cycle

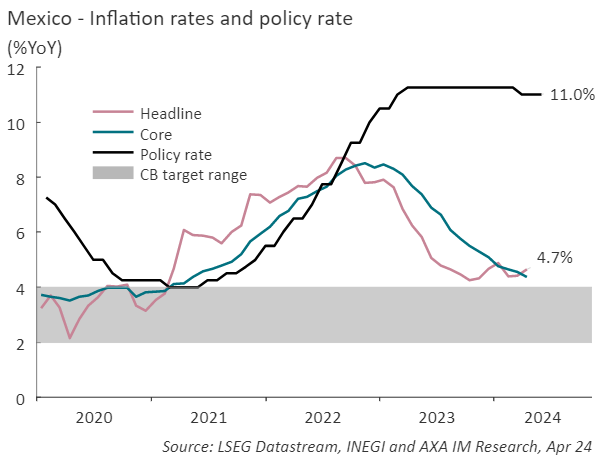

In line with expectations, the Bank of Mexico (Banxico) maintained its policy rate at 11% in a unanimous vote at its May monetary policy meeting. This decision marks the first pause in the easing cycle, as Banxico had suggested might occur, albeit coming at a very early stage. The easing cycle began just one meeting ago in March with a 25-basis point cut. The exchange rate and Mexican local rates remained relatively stable after the decision, indicating that the market had already priced in Banxico’s decision to pause.

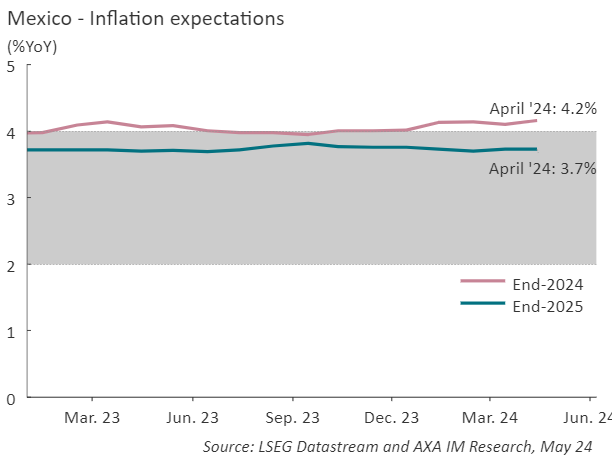

Despite the uptick in headline inflation observed since the last policy meeting (April: 4.7%), Banxico acknowledged in its statement that this increase primarily stemmed from the non-core component. It also noted with approval that core inflation continued its downward trend, reaching 4.4% in April. In this context, the central bank stated its expectation for the ongoing disinflationary process to persist. However, the Board expressed concerns about the stickiness of services inflation, leading to an adjustment in its 2024 inflation forecast. It was revised slightly upwards to 4.0% from the previous 3.9%. Conversely, the 2025 forecast was revised downward by 0.1 percentage points to 3.0%. Additionally, Banxico postponed the timeline for inflation convergence to its 3% target. Now, it expects this convergence to occur in Q4 2025 instead of Q2 2025, as stated at their previous meeting. We envisage a similar trajectory for inflation this year (4.0%) and a higher rate (3.5%) for 2025.

Regarding the Mexican economy, the Board emphasized that the economic softness observed towards the end of 2023 likely persisted into early 2024, despite the labour market's resilience. This outlook aligns with preliminary estimates of Q1 GDP, which showed growth decelerating to 1.6% year-on-year from 2.5% in Q4, the slowest expansion since Q1 2021. We foresee growth continuing to slow throughout the rest of the year due to factors such as high interest rates, a decelerating US economy, and a decrease in remittances in pesos, reflecting the strength of the local currency. Nonetheless, increased public spending ahead of June’s general elections, alongside easing inflation and robust labour market conditions, are expected to provide some support. All things considered, we see growth moderating to 2.2% this year and edging down further to 2.1% in 2025.

Banxico, as in its previous meeting, refrained from offering explicit forward guidance in its policy statement. Instead, it indicated that it will "assess the inflationary outlook to discuss adjustments to the reference rate" in the future. This underscores the bank's commitment to remaining data-dependent. The Board also emphasized that, with this decision, the monetary policy stance remains restrictive. We expect Banxico to resume its easing cycle in June, following an approach of cutting rates at every other meeting. We see the policy rate reaching 10.25% by the end of this year and 7.50% by the close of 2025.

Related articles

US reaction: Inflation slowing in line, but nothing weaker

- by

- 14 August 2024 (3 min read)

UK reaction: Confirmation for the Bank of England

- by

- 14 August 2024 (5 min read)

UK reaction: A further step in the right direction for the MPC

- by

- 13 August 2024 (3 min read)

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.