EM reaction: no respite (yet) in inflation pressures in Turkey

- 03 April 2024 (3 min read)

March headline inflation reached 68.5% year-on-year, core inflation reached 75.2%, from 67.1% and 72.9% respectively in February

On a month-on-month basis, consumer prices progressed by 3.2% which was below the 3.5% expected by the Reuters consensus. Still, inflation rate shows no signs of respite so far, in spite of the 4,150bp cumulative interest rates hike delivered by the Central Bank of Turkey (TCMB) since May 2023.

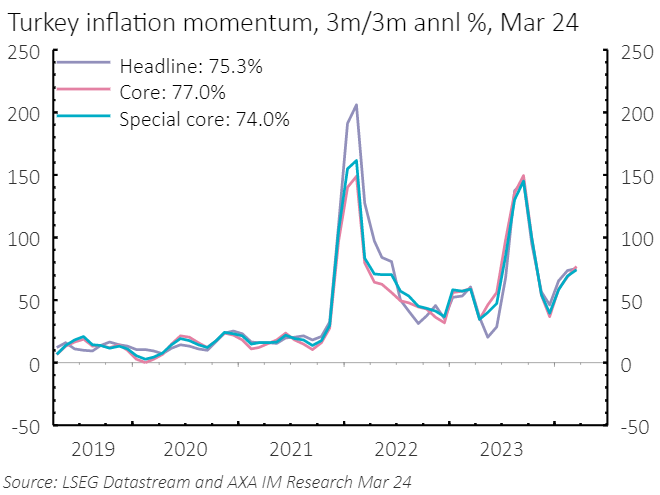

Inflation momentum points to higher inflation for some months to come

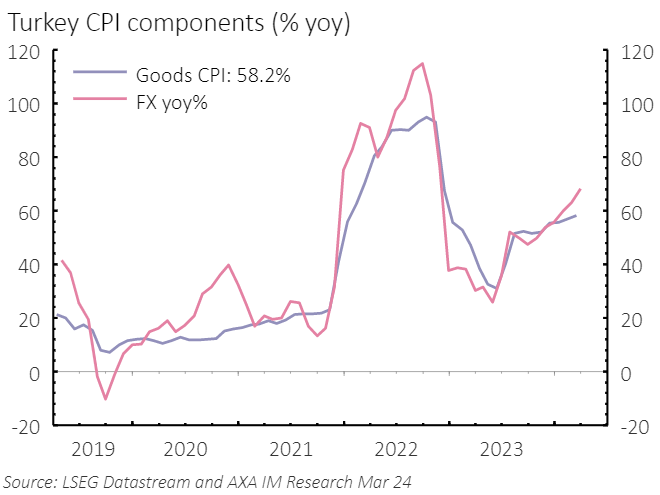

Food prices were helpful in March but clothing, transportation and housing prices all pushed inflation higher. In March, goods inflation run at 58.2% and remained under pressure given the past currency depreciation pass-through via imports. Services prices, in particular, which usually display more stickiness, have continued to post a strong increase (+4.2% month-on-month), annual inflation in the services sector accelerated thus further to 96.5%. On a 3-month/3-month annualized basis, core and special core inflation momentum is running around 74-77%.

Inflation expected to decline in the second half of the year

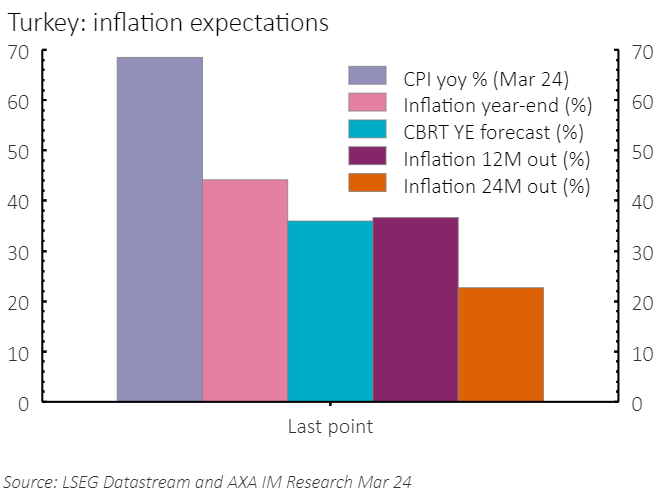

In its latest inflation report (February), the TCMB was expecting headline inflation to increase throughout the first half of 2024 and decline steadily as of the second half, to reach 36% at the end of 2024 and 14% at the end of 2025. March survey of expectations pointed to further de-anchoring of inflation expectations, at 44.2% for year-end, which in turn has contributed (alongside other factors) to the latest 500bp rate hike. We expect inflation to continue to accelerate at least until May-June, and start decelerating thereafter. The pace of deceleration will be intimately linked to the forcefulness of the fiscal policy tightening measures which should be implemented now that the local elections are out of the way. For now, we pencil in inflation closer to 45% year-end and we do not expect further rate hikes. The central bank retained quite a hawkish forward guidance: “Tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and inflation expectations converge to the projected forecast range. Monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen.” We believe they will be inclined to keep a tight stance through the rest of the year and would only revert to rate cuts if inflation decelerates quicker than expected. For now, we expect policy rates unchanged at 50% by year-end.

Related articles

View all articles

Take Two: US Q2 GDP revised up; Eurozone inflation falls sharply

- by

- 02 September 2024 (3 min read)

US reaction: Powell speech – getting into a hole?

- by

- 23 August 2024 (3 min read)

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.