UK Outlook – Lags could push Bank of England to faster cuts

- 30 November 2023 (5 min read)

Key points

- Although BoE policy appears to have peaked, rising mortgage rates will continue to tighten monetary conditions throughout 2024

- We see the economy on the cusp of recession in 2024, with risks skewed lower. Growth should accelerate somewhat in 2025

- Given the policy lags, we see the BoE easing from August next year – and more quickly than expected

Lags threaten recession

The UK has had a difficult year but the past 12 months have seen inflation fall to 4.7% from 11.1%, the economy avoid recession and gilts outperform their peers. But 2024 looks set to be tougher. Further disinflation should support household spending power but tighter monetary policy is likely to bear down on households. Despite a smaller proportion of outstanding mortgages, the impact of the sharp rise in mortgage rates will be marked. It is also lagged, with more fixed deals than in previous cycles (Exhibit 1). This delayed the impact this year, but looks set to grow next, including via pass-throughs to rents (already rising at a double-digit pace) as buy-to-let landlords pass on higher borrowing costs.

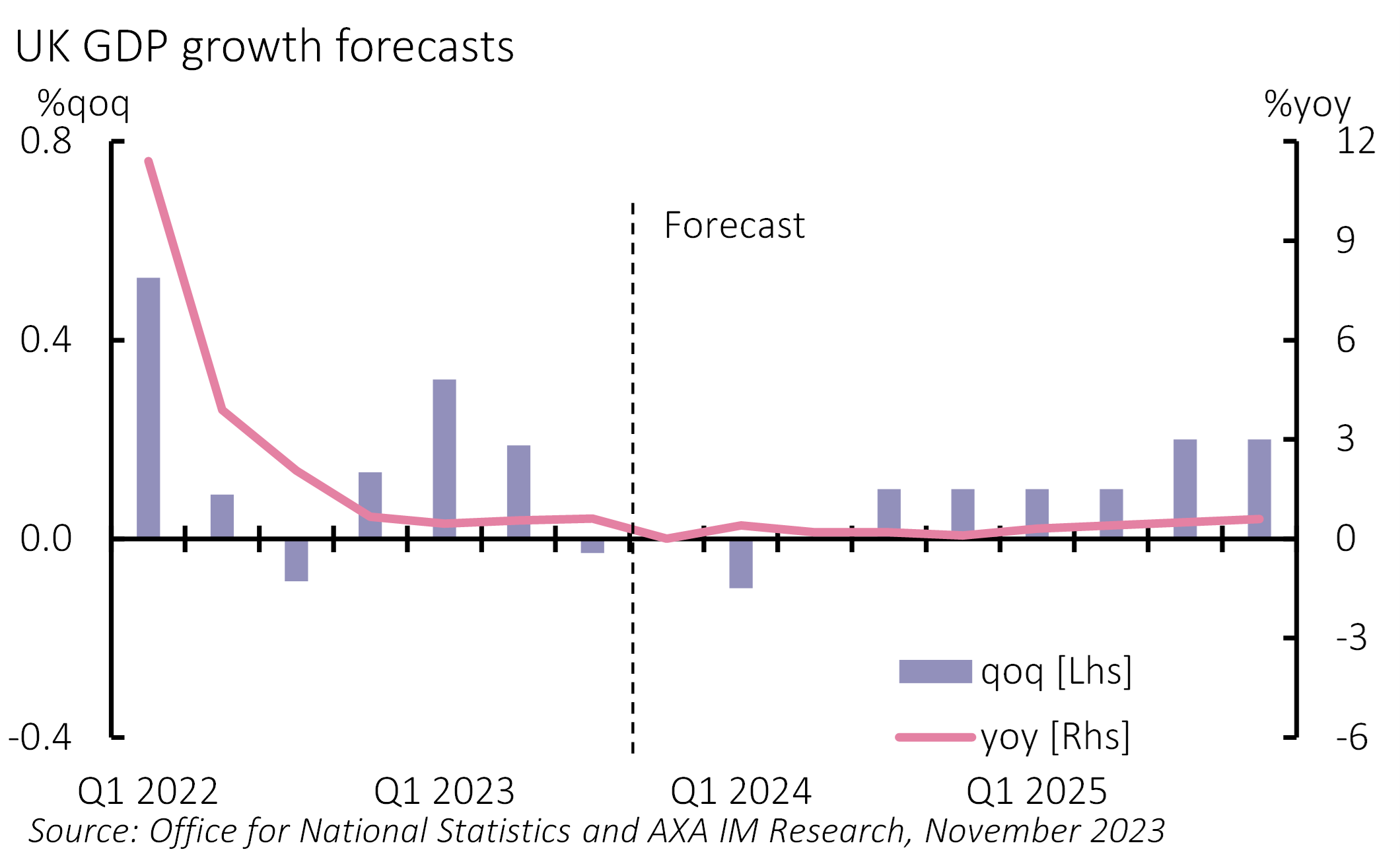

Exhibit 1: UK projected to narrowly avoid recession (again)

Weak consumer spending is likely to dominate the GDP outlook for 2024 and 2025. However, a weak cyclical outlook, elevated borrowing rates and political uncertainty, including infrastructure project cancellations and government commitment to climate change are also likely to contribute to weaker investment. We forecast GDP growth of 0.0% in 2024 and 0.5% in 2025 (from a forecast 0.5% in 2023). Our central view is perilously close to recession, with risks skewed in this direction. However, we forecast a modest acceleration in activity across 2025 as the pass-through of previous tightening ebbs and we anticipate fresh easing.

Weaker growth should loosen the labour market further. We forecast a rise in unemployment to 5% from 4.2% at present, a rise we see occurring sooner than the Bank of England (BoE) does. As such, we forecast wage growth slowing from an elevated 7.9% at present to below 4% by end-2025. Such an easing in labour conditions would help disinflation. The decline in inflation to date is because of a combination of falling energy inflation, slower food price inflation and a sharper fall in non-energy core goods. Services inflation remains elevated for now but has started to ease. The expected loosening in the labour market should see further services disinflation. We forecast inflation averaging 7.5% in 2023, 3.1% in 2024 and 1.8% in 2025. Our forecast sees inflation falling below target by mid-2025. We also recognise a risk that wage inflation remains stickier, which could delay broader services disinflation.

The BoE has left its benchmark interest rate at 5.25% since September and we think it has peaked. The lagged transmission of previous tightening is likely to tighten conditions further across 2024 and into 2025, even as spare capacity rises, and inflation falls. We expect the BoE to start easing policy in 2024 as its focus shifts to inflation falling below target the following year and being on track to remain there over its forecast horizon. We expect the BoE to confirm wage growth deceleration next spring before lowering interest rates by 25bp in August (with risks skewed to an earlier cut). We then forecast rate cuts to 4.50% by end-2024 and to 3.75% by mid-2025 – a sharper reduction than markets currently expect. We also expect the BoE to maintain quantitative tightening through 2025, with a broadly stable pace of active sales.

The UK is also due a General Election within the coming two years – most likely in October 2024. Polls and recent by-elections point to a Labour government for now, although the current Conservative government has a sizeable majority. Both parties are once again competing over the centre ground (having diverged to extremes over the last decade). A centrist government and significant fiscal constraints should limit the differences either new government has on the economy for 2025. We expect a modest fiscal easing (around 0.5% of GDP) in March. A new government is likely to need to tighten significantly in the first few years of the next term, which may add to a loosening monetary policy dynamic.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.