Winners and Losers for 2023: Which asset classes might be in focus?

- 31 January 2023 (5 min read)

Key points:

- In 2022, there was nowhere to hide. The year of all records was marked by a wave of massive risk reduction and a historic bond crash.

- We approach 2023 with cautious optimism and favour bonds in the first part of the year, before returning to equities when earning expectations reflect recession risk.

- The asset classes we see with, and without, potential in 2023.

Lessons from 2022 for 2023

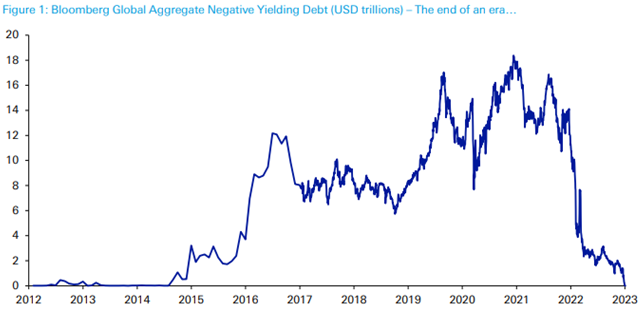

In 2022, we lived through historic moments. In particular, it was the worst year on the bond market in decades, such as the 10-year US Treasury bills, which at the end of June experienced their largest one-year decline since the end of the eighteenth century1 . Another surprise was that we went from the equivalent of $18 trillion of debt on the markets in negative interest rates in July 2021 to... no negative rate debt at the beginning of January 2023. A brutal turnaround.

Source: Bloomberg Finance LP, Deutsche Bank, January 2022

On the equity side, the first half of 2022 was one of the worst first half on record in financial markets in decades, as the S&P 500 recorded its worst performance since 1962. Revenues suffered in 2022, with a lot of sectoral and geographical dispersion, especially technology and, more broadly, growth management. However, a rare phenomenon, Europe is doing – in relative terms – much better than the United States.

2022 was also the year of a major paradigm shift, with a strong correlation between different asset classes and historically high inflation.

In the table below, often used to illustrate the benefits of diversification, we see that asset classes show very variable returns over the different years, but in 2022, they are all moving broadly in the same direction, with the exception of commodities.

Source: AXA IM as at 31 December 2022

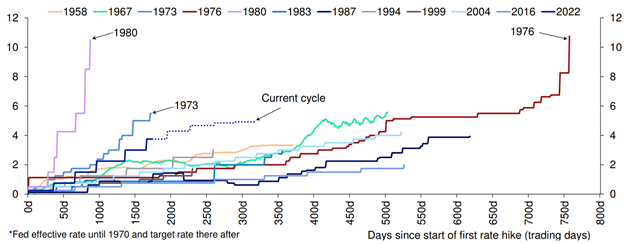

In 2023, the situation is expected to be very different due to (i) the end of the expected rate hike cycle in the first part of the year in the United States and mid-year in Europe; and (ii) the mild recession that we expect on both sides of the Atlantic. This environment will undoubtedly be conducive to strong uncorrelations, and therefore to the return of the benefits of diversification in multi-asset class portfolios, and also the opportunity for active managers to make a difference in stock selection.

Cumulative Fed rate hikes through hiking cycles (%)

Source: Deutsche Bank as at December 2022

For the first part of 2023, we favour emerging market debt and equites, short-duration credit and within currencies, the Yen.

We believe that the tide could turn quickly during the year, and we will probably have to change the allocation we are putting in place today for the first quarter of the year, potentially with a reversal of trend between the second quarter and the second half of the year.

1. Emerging market equities and debt

Growth is expected to become more resilient in emerging markets. The end of the zero covid policy and the massive restart of the Chinese economy should fuel global growth. Also, the inflationary shock is relatively less strong in emerging countries than in developed countries because they de facto have structurally higher inflation. As a result, we expect inflation to fall below target by the end of 2023 in a number of countries. As such, emerging central banks have raised rates one step ahead of those of developed countries, and some may even start cutting rates this year. In addition, the value levels are particularly attractive.

Finally, the prospect of a weaker dollar should enable emerging countries that borrow in a nutshell to repay their debts at a lower cost.

2. Short-duration credit

Two components explain our positive views on this asset class. The carry, which corresponds to the gross yield of a bond, and the price. At the time of writing, the carry is around 6.5% on high-yield credit and 3% on 5-year investment grade credit in euros2 . The advantage of short duration lies in its lower sensitivity of the bond price to changes in interest rates. Despite the recession we are heading into, the likely increase in default rates is not a drag on the asset class. Indeed, i) this expected increase is already reflected in the level of credit spreads, ii) the default-adjusted carry will remain interesting.

3. The Japanese yen

The Bank of Japan remains the last major central bank in developed economies not to have raised interest rates. This divergence from other central banks weighed heavily on the yen, which reached extreme valuation levels last October, with a low since 1990 against the dollar. That is likely to change this year. Inflation is accelerating in Japan and surprising on the rise, which should lead the Bank of Japan to emerge from its isolation and gradually tighten its monetary policy, especially since the emblematic governor of the Bank of Japan, Kuroda-san, will hand over the reins this year.

At this point, we see less value in US equities, European equities and the dollar.

1. U.S. equities

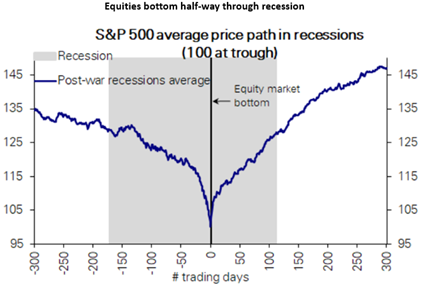

Stocks are generally at their lowest point during the recession. Not at the beginning, not at the end, but during the recession (chart below). Also, they do not reach their low point until the last rate hike of the Fed. To date, these two conditions have not yet been met: the United States has not yet entered recession, especially since inflation remains difficult to control. The low point is coming, in all likelihood, in the coming months.

Source: Deutsche Bank, December 2022

We believe the US market remains expensive, and valuation levels would need to fall further to become attractive. The benefits will also have to adjust downwards at the dawn of the recession. To date, earnings expectations for 2023 have been revised downwards, but corporate profits have not yet declined.

2. The dollar

Sensitive to interest rate movements, we believe that the dollar should weaken in 2023. Indeed, we are approaching the time when the Fed will stop raising its key rates (first pivot), while the European Central Bank should continue to raise them longer, thus favouring the euro. In addition, the United States should enter recession at a time when Europe could do better, helped in particular by the reopening of the Chinese economy and the moderation of commodity prices. In addition, the greenback seems expensive to us today.

We will be watching closely for future events that may change the trends we see today, with a view to adjusting our allocations and getting the alpha where we think it is.

- U291cmNlOiBBWEEgSU0sIERlY2VtYmVyIDIwMjI=

- U291cmNlOiBCbG9vbWJlcmcsIGFzIGF0IDE3IEphbnVhcnkgMjAyMw==

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.